INVESTMENT APPROACH

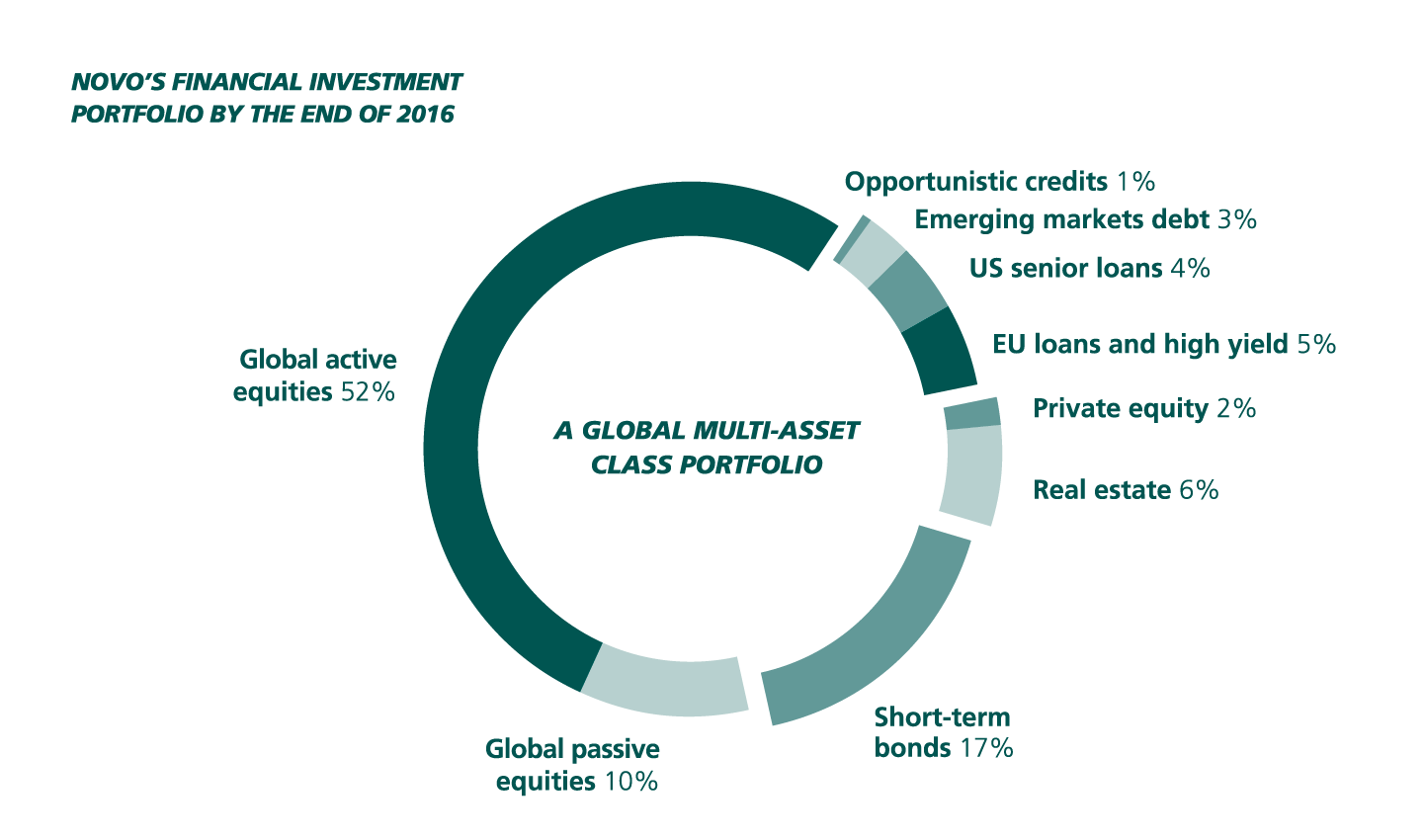

Novo's financial investment portfolio consists of equities, credits, bonds and illiquid investments. Some of these investments are managed external and some are managed in-house.

EQUITIES

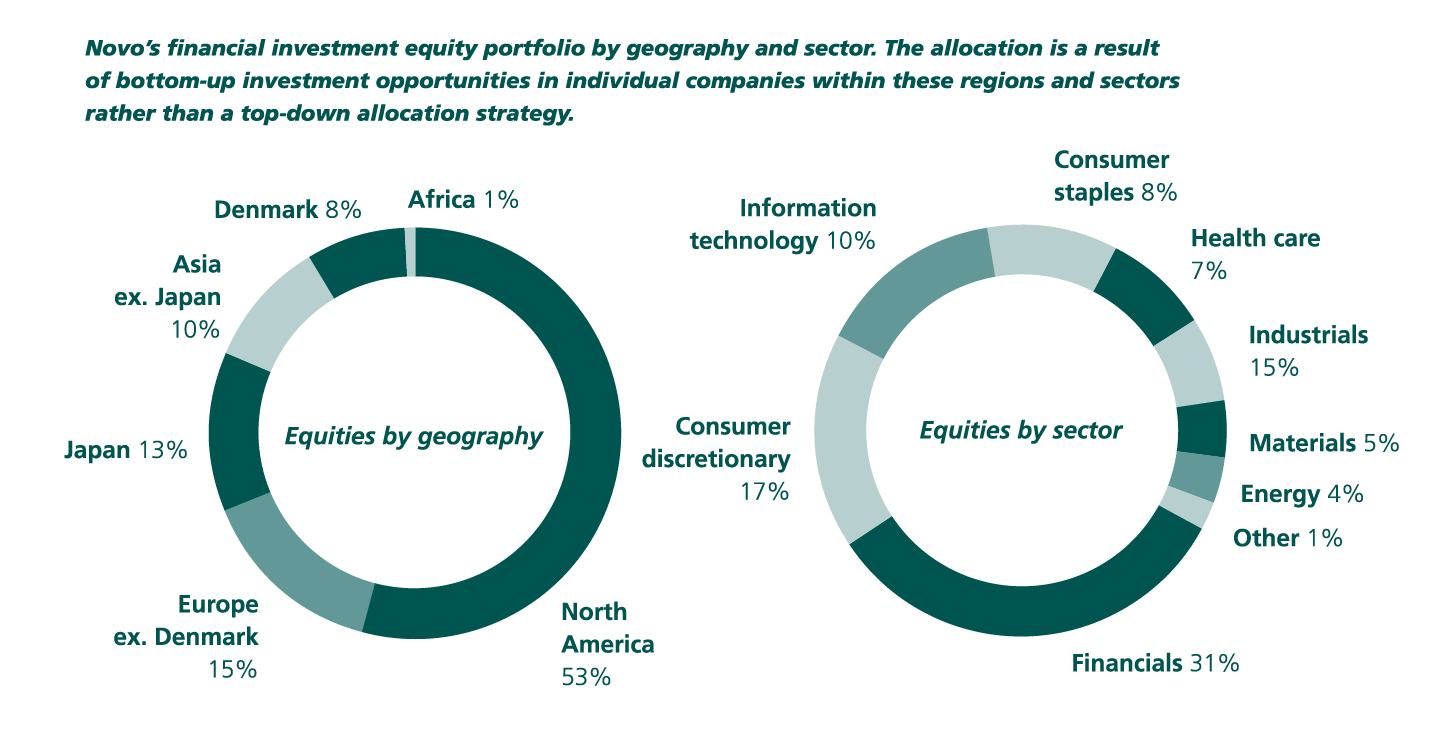

Novo’s equity portfolio is liquid and diversified. Around 15% of the equity portfolio is currently allocated to highly liquid index products.

The remaining 85% is invested in about 250 different listed companies that have been carefully selected by our active managers (the 20 largest externally managed holdings account for a third of the equities).

By the end of 2016, our actively managed equities were split between 13 external managers in a mix of global, regional and country-specific mandates.

CREDITS

Novo’s credit portfolio is diversified across several types of underlying risk sources. These assets can be broadly classified into the following categories:

- Emerging market debt

- Senior secured loans issued by corporations

- Commercial real estate debt

- High-yielding debt issued by corporations

- Subordinated debt issued by financial institutions

BONDS

Novo’s bonds are managed in-house. A large bulk of our bonds are covered bonds issued by Danish mortgage institutions.

Our fixed-rate covered bonds typically have a few years to maturity, which makes them less sensitive to changes in interest rates.

The bond portfolio also consists of investments in the safest tranches of securitised pools of international corporate loans.

Finally, we have a few minor positions in bonds issued by corporations with high credit ratings.

In short, the bond portfolio has a high liquidity, low credit risk and low interest rate risk. By the end of 2016, the bonds amounted to DKK 6.4 billion.